Piramal Enterprise : Is the burden shaking the foundation ?

- Oct 3, 2019

- 4 min read

After DHFL & Indiabulls Housing there seems to be pattern emerging. That is the Real Estate NBFCs are facing the issue of liquidity crunch that is being further burdened as Real Estate Industry is not able to clear the inventory at a fast pace that can help increase prices which is needed sustain cashflow as input cost rising.

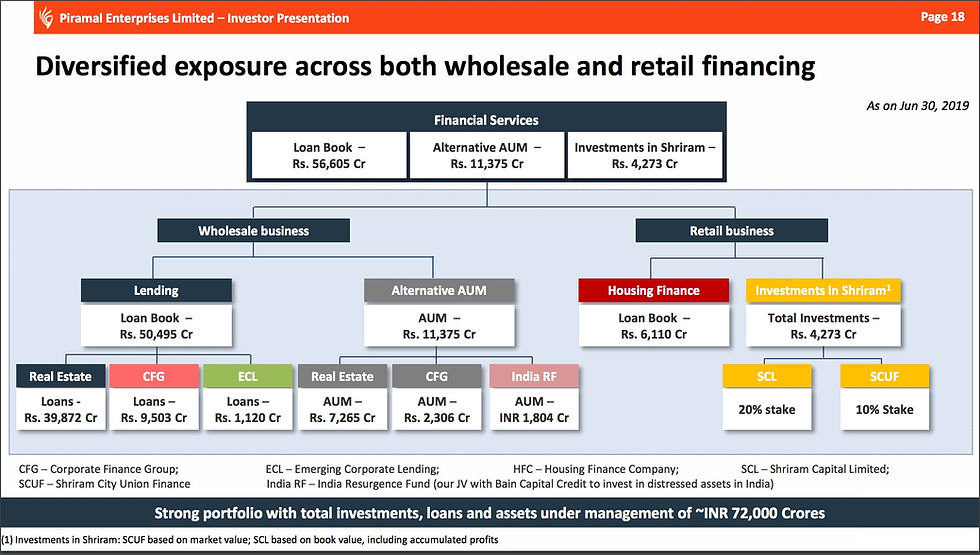

Piramal Enterprise is one of the few NBFCs that is able to show sustainability till now. Being a leader in Real Estate wholesale lending that contributes to 70% of total loan book. This excludes Alternative AUM in Real Estate that is of Rs.7,265 cr as of June 2019. The de-risking process of such concentrated book will take time but in meanwhile as developers cashflow take another round of downgrades the risk amplifies at lenders levels. Total study more in details we split the liabilities and assets into different tenure to understand the issue.

LIABILITIES :

Short Term borrowings has sustained its contribution of 37% to total borrowings while the Commercial Paper contribution to the short term has reduced to 56% from 86% in 2018.

Long Term borrowing has also sustained its contribution of 63% to total borrowings while the bank borrowing that is more available these days has been at 45% of long term borrowing in last two years.

Funds raised by QIP is taken to be low cost , that was last done in October 2017 for amount of Rs.4996 cr via Compulsory Convertible Debentures at cost of Rs.2690/share that is 58% from current price.

Total borrowing growth rate of NBFC indicates the loan growth in current year and its ability to fund the future growth more sustainable rate. During FY 18 the borrowing growth rate was 46% compared FY 17 that was contributed more by Commercial Paper but in FY 19 it is 9.5%.

ASSET :

Short Term Loans have doubled in terms of contribution to total loans from 6.32% to 13.33% this can improve cashflow position of the company but it is still on the lower contribution to make a big impact.

Long Term Loans contribution is at 87% in 2019 as compared to 94% in 2018 that was mainly funded by rolling of short term funding. This is still at high levels which that might result cashflow urgency if the short term funding faces some issues.

Cash is at 6% of Short Term borrowings as compared to 12% -16% in FY 2017 & 2018 .This results in constant need to raise the funds as the proportion of short term borrowing is stable and has not reduced.

Cash & Current Investments form 8% of total borrowing as compared to 19% average of previous two years. The current cash was used to repay some part of liabilities but such a ratio will be needed to maintained to meet the liabilities which still growing.

HOLDING & OTHER :

Holding between FII & Domestic MF have remained stable with minor change during September 2018. It also shows some risk as there has not been much interest of ownership from DII which will become an issue if and when FII start liquidating the positions.

Ratios :

Total Borrowing is 110% of Total Loans that might result in more cashflow outgo in FY 2020 than inflow . Benchmark : HDFC Ltd. is 75%

Short Term Borrowing is 3 times Short Term Loan that means that short term is funding more of Long Term loans resulting in cash inflow being spread over longer period.

Benchmark : Bajaj Finance is 0.41

Cash & Current Investments is 7.9% Short Term Borrowing resulting in low cash available putting stress on choice of fund raising.

Benchmark : HDFC Ltd. is 19.4%

UPDATES OF FY 2020 :

Sources of Funds raised other than CP and CP Rate that dominates the cost of funds :

June 2019 - Piramal sell entire stake in Shriram Transport - Rs.2,300 cr - Secondary CP Rate - 8.53%

July 2019 - Raised via NCD from Standard Chartered - Rs. 1,500 cr - Secondary CP Rate - 8.75%

July 2019 - Raised via NCD from Sachin Bansal - Rs. 200 cr - Secondary CP Rate - 8.75%

August 2019 - Deferred NCD issue to investors - Rs. 3000 cr - Secondary CP Rate - 9.50%

September 2019 - Raised via NCD from Credit Suisse - Rs. 690 cr - Secondary CP Rate - 9.45%

*Secondary CP Rate is of 7-10 days before maturity

Our View :

We believe having a large exposure to real estate wholesale lending has put the company at big risk and since last 12 months it has not been able to de-risk the book as quickly it would like to. And the cashflow matching is becoming difficult as more funds are being deployed to the liabilities and less is able to be deployed to loan growth.

The cost of funds is factor of balance sheet and comfort the lender/investor has in the loan book that currently is exposed to sector that has been facing incremental liquidity issue since last 6 to 9 months. We expect a big spike in cost of funds in next 6-9 months until there is big dilution via Institutional Investor which at this valuation and sector concentration looks difficult.

We Recommend a SELL on the company.

Comments