Front-Run

- Sameer Kalra

- May 15, 2019

- 2 min read

Today's Market Influencer :

Today Movement - Neutral to Negative

US market Future Indices and Asia Indices are mixed as there is a cool off in the escalation of the trade war though preparations for auto tariff and balance good hike is in process from USA .The oil prices are at $71.18/bbl(0.44%) as Middle East crisis brew higher and trade war talks cool off price move up. USDINR at 70.40(0.13%) as crude remains near $70/bbl and FII selling puts pressure more stronger.

We expect markets to be Neutral to Negative as FII selling continues there is pressure on an rally in addition Crude is also up due to Middle East tensions. There is slight risk of short covering today.

Important Day Close Level is 10983/11352

Stock of the Day :

Pidilite Industries Ltd. - Stop Loss 1154/1164 & Target 1119/1109/1085

Revenue grew 8% YoY and Gross margins faced pressure along with EBITDA Margin due to RM cost spike which the company was not able to pass on fully. The main disappointment at high valuations is the volume growth of consumer business came at 4% lowest in recent quarters and Industrial volume showed -1% growth.

We would be negative for intraday trade.

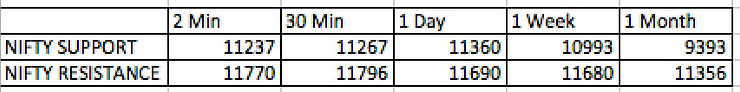

POSITIONAL NIFTY LEVEL :

NIFTY LEVELS

ALERT : PREVIOUSLY NIFTY CLOSED NEAR ALL IMPORTANT LEVELS INDICATING THERE WAS NO CLEAR SIGN OR BREAKING THE RANGE . WE SEE SOME DOWNSIDE WITH GLOBAL MARKETS ALONG WITH ELECTIONS RESULTS CLOSE AND WE HAVE BOOKED SOME MORE PROFITS AND INCREASED CASH POSITION TO 45% FROM 40%.

Note : These are derived from an Internal Indicator and any movement or close below/above Support/Resistance of one time period moves the Support/Resistance to next time period.

Example : if current market levels is below or above 2 min levels then immediate levels to keep watch are 30 Min levels.

Comments