Today's Market Influencer :

Today Movement - Neutral to Positive

US market Future Indices and Asia Indices are negative as TradeWar will get escalated and deal might only happen post 2020 elections.The oil prices are at $61.22/bbl(-0.08%) as PMI numbers come below than estimate for Japan & Hong Kong . USDINR at 69.70(0.00%) as crude prices remain flat.

We expect markets to be Neutral to Positive as reports suggest some way out for FPI surcharge via circular this week.

Important Close Level is 10863/11257

Stock of the Day :

Union Bank of India Ltd. - SELL - Stop Loss 66/67.6 & Target 63/62.2/61

(IMP : Do not trade if opens at Stop loss/Target levels)

Bank saw an increase in provisions and NPAs as Agri & large accounts were recognised as bad loans. Profitability increased based on Treasury Income where as NIMs soften. DHFL resolution might get delayed as DSP has filed suit against the company.

We would be negative for intraday trade.

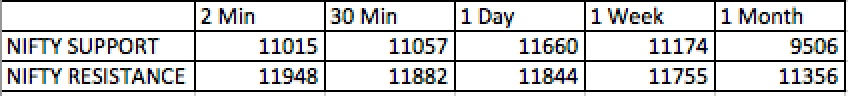

POSITIONAL NIFTY LEVEL :

NIFTY LEVELS

ALERT : PREVIOUSLY NIFTY CLOSED NEAR ALL IMPORTANT LEVELS INDICATING THERE WAS NO CLEAR SIGN OR BREAKING THE RANGE . WE SEE UPSIDE WITH FIIs BUYING AROUND 55,000-60,000cr DURING SIX MONTHS POST ELECTION WHICH WOULD BRING BIG UPSIDE IN MIDCAPS TOO. INCREASE CASH ALLOCATION TO 50%.

Note : These are derived from an Internal Indicator and any movement or close below/above Support/Resistance of one time period moves the Support/Resistance to next time period.

Example : if current market levels is below or above 2 min levels then immediate levels to keep watch are 30 Min levels.

Comments